Gift Contribution Limits 2024. The contribution limit for 401(k) plans will increase in 2024 to $23,000 (from $22,500). Year of gift annual exclusion per donee annual exclusion total per donee (from 2 spouses) 2011 through 2012:

Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2024, $18,000) per. Contribution limits are $3,850 in tax year.

The Maximum Credit Allowed For Adoptions For Tax Year.

Earnings limit for people in the.

$6,500 For Tax Year 2023 And Will Rise To $7,000 For 2024.Those Over 50 Can Contribute An Additional $1,000 Per Individual.

1 for 2024, the limit has been adjusted for inflation and will rise to $18,000.

The Contribution Limit For 401(K) Plans Will Increase In 2024 To $23,000 (From $22,500).

(that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts.

Images References :

Source: www.jackiebeck.com

Source: www.jackiebeck.com

401(k) Contribution Limits for 2024, 2023, and Prior Years, The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient. The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023.

Source: www.medben.com

Source: www.medben.com

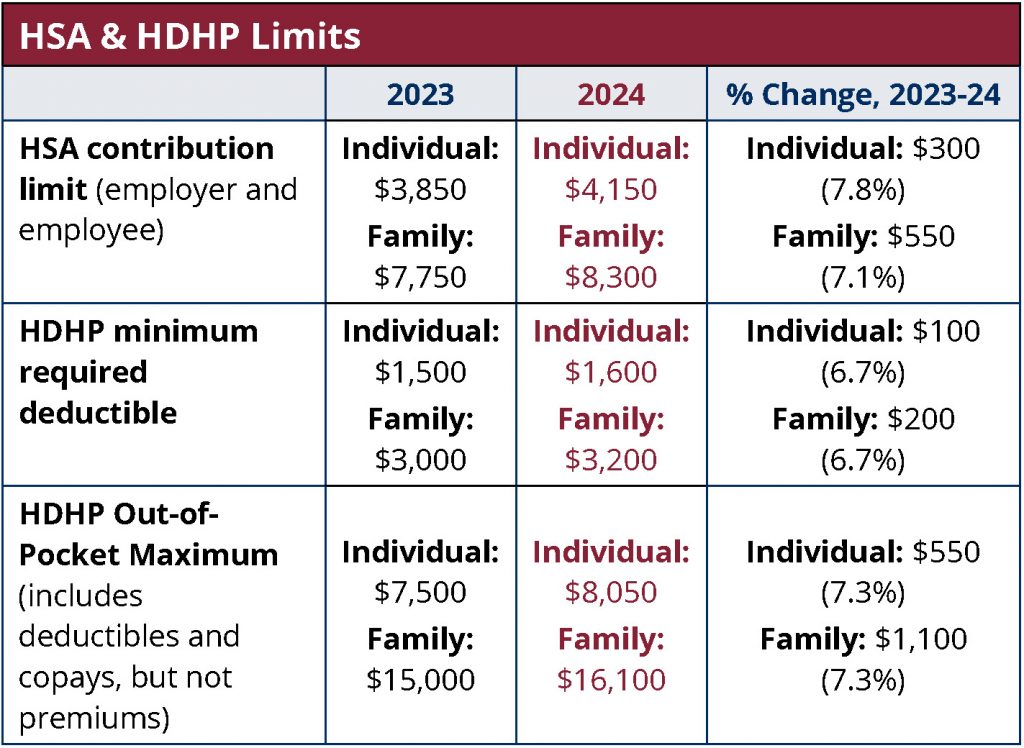

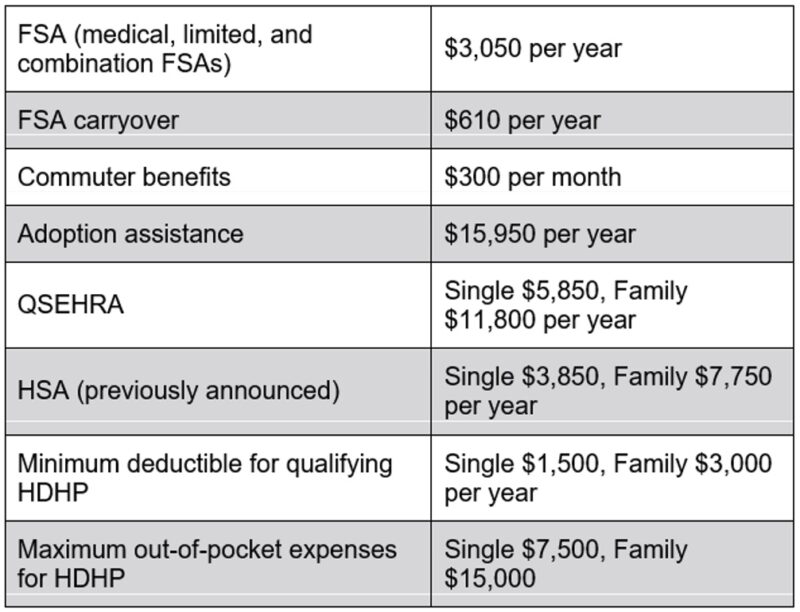

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, I will be voting no to the referendum. The maximum credit allowed for adoptions for tax year.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, $6,500 for tax year 2023 and will rise to $7,000 for 2024.those over 50 can contribute an additional $1,000 per individual. This means you can give up to $18,000 to as many people as you want in 2024 without any of it being subject to the federal gift tax.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

529 Plan Contribution Limits For 2023 And 2024, The maximum credit allowed for adoptions for tax year. Contribution limits are $3,850 in tax year.

Source: www.insidepoliticallaw.com

Source: www.insidepoliticallaw.com

California Raises Campaign Contribution and Gift Limits for 20232024, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts. Year of gift annual exclusion per donee annual exclusion total per donee (from 2 spouses) 2011 through 2012:

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, Those with 401(k), 403(b), 457 plans, and similar accounts will see a $500 increase for 2024, bringing the total maximum contribution amounts to $23,000. Retirement limits, tax brackets and more.

Source: www.taxuni.com

Source: www.taxuni.com

IRS Gift Limits From Foreign Persons 2024, $6,500 for tax year 2023 and will rise to $7,000 for 2024.those over 50 can contribute an additional $1,000 per individual. The maximum credit allowed for adoptions for tax year.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, The exclusion limit for 2023 was $17,000 for gifts to individuals; If a gift exceeds the $18,000 limit for 2024, that does not automatically trigger the gift tax.

Source: corporatebenefitsnetwork.com

Source: corporatebenefitsnetwork.com

2023 IRS Contribution Limits Corporate Benefits Network, For 2024, the annual gift tax exemption is $18,000, up from $17,000 in. For 2024, the annual gift tax limit is $18,000.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Solo 401k Contribution Limits for 2022 and 2024, The federal government imposes taxes on gifts of property made during a taxpayer’s lifetime, or at death, that exceed certain exemption limits. New contribution and gifting limits for 2024.

Those With 401(K), 403(B), 457 Plans, And Similar Accounts Will See A $500 Increase For 2024, Bringing The Total Maximum Contribution Amounts To $23,000.

What is the 2023 and 2024 gift tax limit?

(That’s Up $1,000 From Last Year’s Limit Since The Gift Tax Is One Of Many Tax Amounts.

2024 hsa contribution limit jumps nearly 8 medben, the increase in the gift tax annual exclusion and the basic exclusion will allow taxpayers to give more of their estates away.

The Gift Tax Is What The Giver Pays If They Exceed Certain Gift Limits In Any Given Year.

The maximum credit allowed for adoptions for tax year.

Posted in 2024