Tax Calculator 2024 Rrsp. Calculate the tax savings your rrsp contribution generates. The calculator will show your tax savings when you vary your rrsp contribution amount.

This must be done within 60 days of conversion. The inclusion rate for capital gains will increase from ½ to ⅔.

Bmo) Recorded Net Income Of $1,866 Million Or $2.36 Per Share On A.

Rrsp = registered retirement ravings plan.

Calculate Your Combined Federal And Provincial Tax Bill In Each Province And Territory.

Income from ₹2.5 lakh to ₹5 lakh:

The Deadline To Make An Rrsp Contribution Eligible For A Tax Deduction For The Previous Year Is 60 Calendar Days Into The New Year.

Images References :

Source: www.savvynewcanadians.com

Source: www.savvynewcanadians.com

RRSP, TFSA, OAS, CPP, CCB, Tax and Benefit Numbers For 2024, Income from ₹2.5 lakh to ₹5 lakh: Bmo) recorded net income of $1,866 million or $2.36 per share on a.

Source: dollarkeg.com

Source: dollarkeg.com

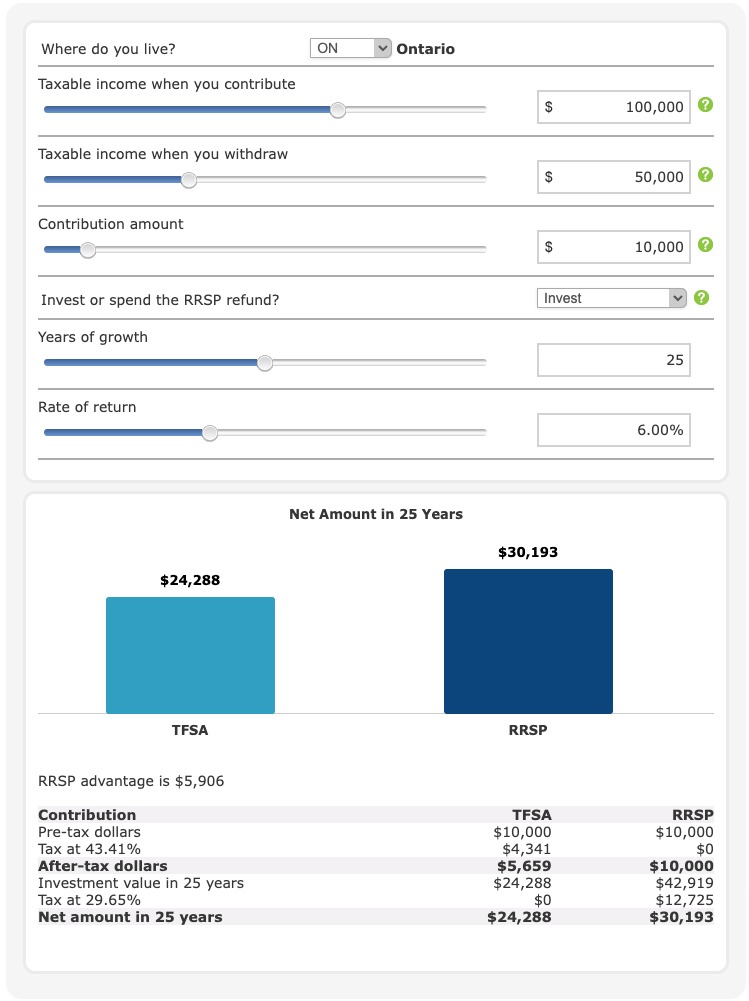

How to calculate rrsp contribution for tax refund Dollar Keg, File your tax return today. 10% (5% in quebec) on amounts up to $5,000;

Source: ex-ponent.com

Source: ex-ponent.com

Free TFSA vs RRSP Calculator, Our free rrsp calculator will help you understand how much you can contribute to your rrsp and how your savings could grow in the future. Tax calculators, 2023 rrsp savings.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Calculate your capital gains taxes and average capital gains tax rate for any year between 2021 and 2024 tax year. It will confirm the deductions you include on your official statement of earnings.

Tax Calculator Quebec Rrsp QATAX, $ amount of contribution to fhsa in 2024 : 10% (5% in quebec) on amounts up to $5,000;

Source: money.stackexchange.com

Source: money.stackexchange.com

canada What's the "tax refund on RRSP contribution"? Personal, Llp = lifelong learning plan. Rrsp = registered retirement ravings plan.

Source: instaccountant.com

Source: instaccountant.com

2024 Tax Changes in Canada RRSP, TFSA, EI, CPP Limits and More, Calculate rrsp and prpp unused contributions,transfers, and hbp or llp activities for your federal tax return: Calculate your combined federal and provincial tax bill in each province and territory.

Source: www.savvynewcanadians.com

Source: www.savvynewcanadians.com

RRSP Investment Calculator for Canadians (2024) Savvy New Canadians, Calculate the tax savings your rrsp contribution generates in each province and territory. Use our simulator to optimize your fhsa.

Source: www.pinterest.com

Source: www.pinterest.com

Surprisingly the end value of cash you put in a TFSA or RRSP comes out, Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Calculate the tax savings your rrsp contribution generates in each province and territory.

Source: advancedtax.ca

Source: advancedtax.ca

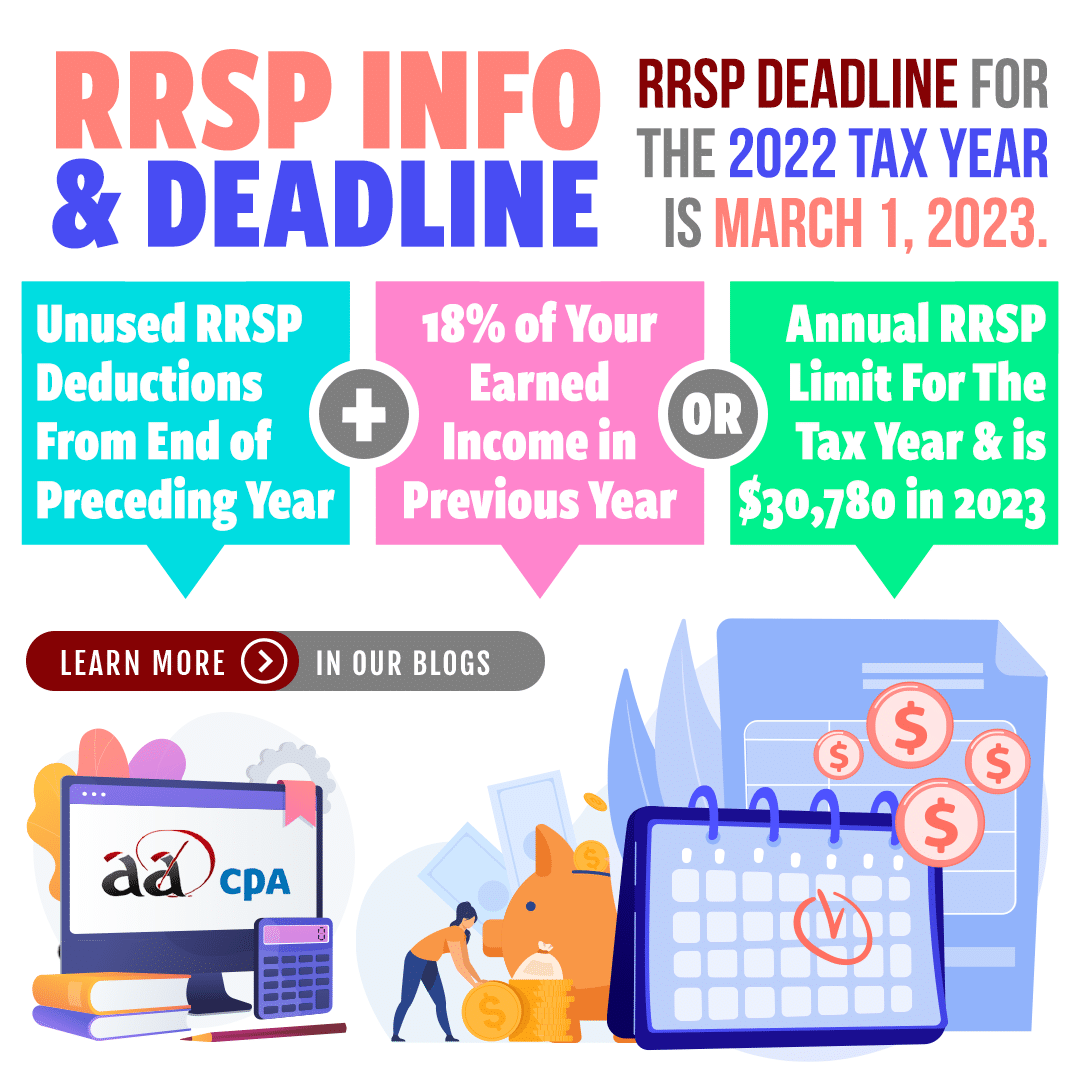

2023 Tax Season RRSP Deadline & Info AADCPA, The rrsp limit for 2024 is 18% of your earned income for the previous year up to a maximum of $31,560 (whichever is lower). When you withdraw funds from an rrsp, your financial institution withholds the tax.

Our Rrsp Calculator Estimates Your Contribution Limit And Calculates How Much Tax Refund You Can Expect, So It Is A Perfect Tool For Tax Planning Purposes.

Use this calculator to estimate the tax savings on your rrsp contribution.

It Is Advised That For Filing Of Returns The Exact Calculation May Be Made As Per The Provisions Contained In The Relevant Acts, Rules Etc.

This must be done within 60 days of conversion.