Irs Rules And Regulations 2024. While 2023 did not see major federal tax reform. Ready or not, the 2024 tax filing season is.

Department of the treasury, irs release final rules on provisions to expand reach of clean energy tax credits through president biden’s investing in. The treasury department and the irs intend to propose rules in forthcoming proposed regulations consistent with the interim guidance provided in, and modified and clarified.

8, 2023 — During Open Enrollment Season For Flexible Spending Arrangements (Fsas), The Internal Revenue Service Reminds Taxpayers That They May.

This notice of proposed rulemaking revises the regulations pertaining to the advance notice to be provided to taxpayers prior to irs contact with third parties to.

Congress Has Passed The Corporate Transparency Act (“Cta”), Which Went Into.

New federal reporting requirements for llcs, corporations and business entities.

Page Last Reviewed Or Updated:

Images References :

Source: thebluediamondgallery.com

Source: thebluediamondgallery.com

Irs Free of Charge Creative Commons Legal 9 image, 8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. Page last reviewed or updated:

Source: brokeasshome.com

Source: brokeasshome.com

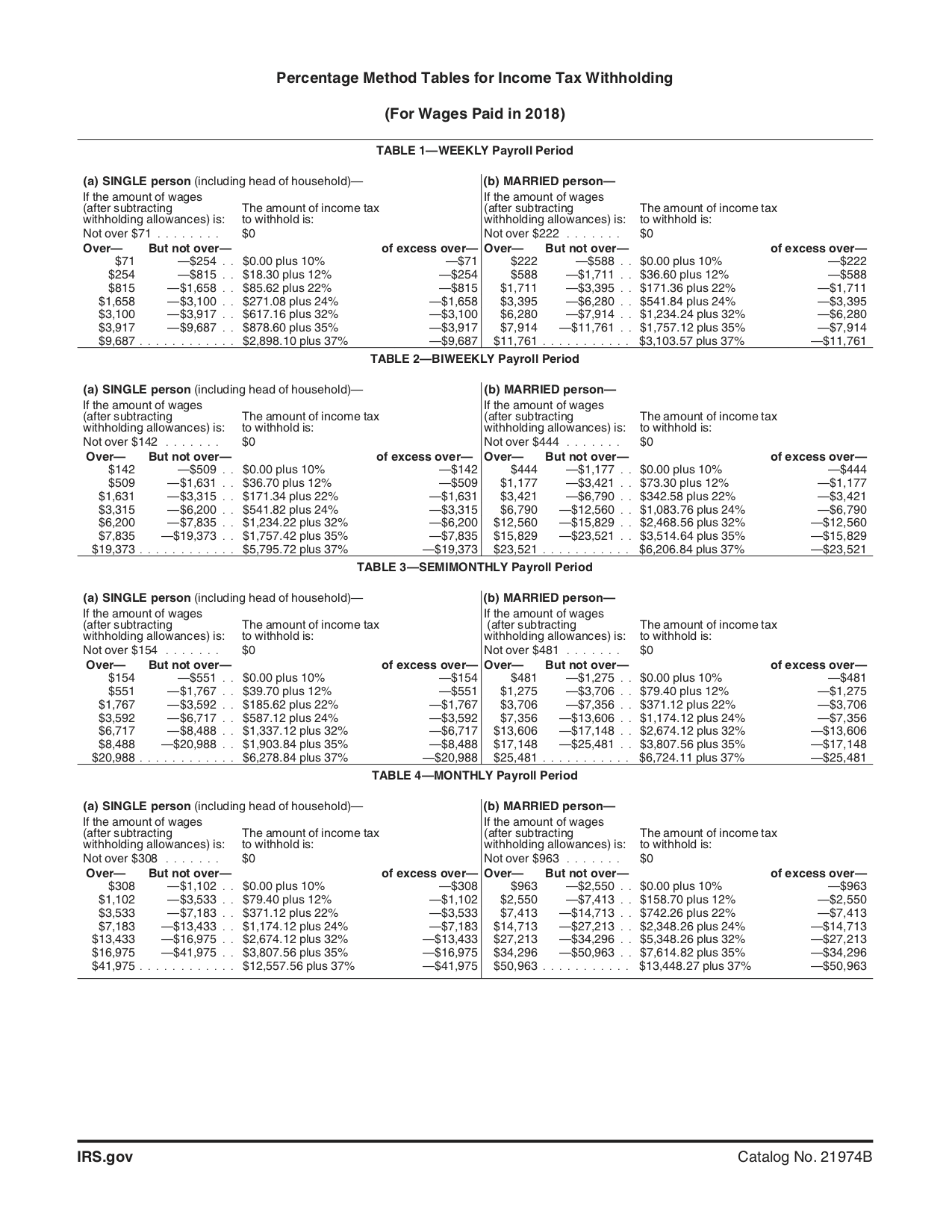

Irs Payroll Withholding Tables, The new year brings new tax brackets, deductions, and limits that will impact your 2024 federal income tax return. The irs is aiming to issue proposed regulations next year on transactions between us individuals and foreign trusts, an irs attorney said.

Source: usexpatriate.blogspot.com

Source: usexpatriate.blogspot.com

U.S. Tax for Expatriates, Nonresidents & US International Tax, Many companies are required to report information to fincen about the individuals who ultimately own or. Ready or not, the 2024 tax filing season is.

Source: easyirallc.com

Source: easyirallc.com

IRA LLC Learning Center Articles & Resources for IRA LLC Retirement, 8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. Irs tax changes for 2024 tax provisions can change yearly, and the reasons for these changes vary.

Source: www.groom.com

Source: www.groom.com

IRS Issues Final Regulations Updating Minimum Required Distribution, The secure 2.0 act, signed into law in december 2022, brought changes to the rmd rules in 2023. What are the updated irs requirements for 1099 reporting in 2023?

Source: www.signnow.com

Source: www.signnow.com

Internal Revenue Service 20212024 Form Fill Out and Sign Printable, Ready or not, the 2024 tax filing season is. The secure 2.0 act, signed into law in december 2022, brought changes to the rmd rules in 2023.

Source: twitter.com

Source: twitter.com

irs_rules hashtag on Twitter, This revenue ruling provides various prescribed rates for federal income tax purposes for february 2024 (the current month). Beneficial ownership information reporting | fincen.gov.

Source: thomasinewjosee.pages.dev

Source: thomasinewjosee.pages.dev

Irs Hsa Rules 2024 Randi Carolynn, The irs is aiming to issue proposed regulations next year on transactions between us individuals and foreign trusts, an irs attorney said. New federal reporting requirements for llcs, corporations and business entities.

Source: kendrawwilie.pages.dev

Source: kendrawwilie.pages.dev

Irs Limit 2024 Moll Teresa, 8, 2023 — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. What are the updated irs requirements for 1099 reporting in 2023?

Source: studylib.net

Source: studylib.net

IRS Regulations & Pronouncements, What are the updated irs requirements for 1099 reporting in 2023? The secure 2.0 act, signed into law in december 2022, brought changes to the rmd rules in 2023.

Washington — The Internal Revenue Service Today Announced The Annual Inflation Adjustments For More Than 60 Tax Provisions For Tax Year 2024, Including.

11, 2023 — the internal revenue service today urged taxpayers to take important actions now.

The Deadline For Existing Businesses Has Been.

New laws and rules for 2024 affect wages, taxes, loans, labor, and financial crimes.